life insurance, health insurance, coverage, benefits, policy, protection, financial security, medical expenses, death benefit, premiums, deductible, provider, family, claims, risks, policyholder, long-term, peace of mind, savings, healthcare, treatment

Understanding Life Insurance

life insurance, coverage, policy, death benefit, protection, financial security, family, long-term, policyholder

Life insurance is designed to provide financial security for a policyholder’s family in the event of their passing. This type of coverage offers a death benefit—a payout to beneficiaries that can help them cover living expenses, debts, or other financial needs after the policyholder’s death. Life insurance policies come in different types, including term life, which covers a specific period, and whole life, which provides lifelong protection. For families, life insurance serves as a safety net, helping them maintain financial stability in difficult times. The policyholder pays regular premiums to keep the policy active, ensuring that loved ones receive protection in the long term.

Understanding Health Insurance

health insurance, medical expenses, coverage, policy, treatment, healthcare, provider, protection, financial security, premiums, deductible

Health insurance covers medical expenses for treatments, doctor visits, and hospital stays, providing essential financial security in case of illness or injury. Policyholders pay premiums to maintain coverage and may also face a deductible before insurance benefits kick in. Health insurance policies are available through employers, private providers, or government programs. By covering routine healthcare and emergency treatments, health insurance allows individuals and families to access needed healthcare services without worrying about high out-of-pocket costs. This protection helps individuals focus on their health without financial strain.

Key Differences Between Life and Health Insurance

key differences, life insurance, health insurance, coverage, benefits, policy, financial security, protection, family, medical expenses, death benefit

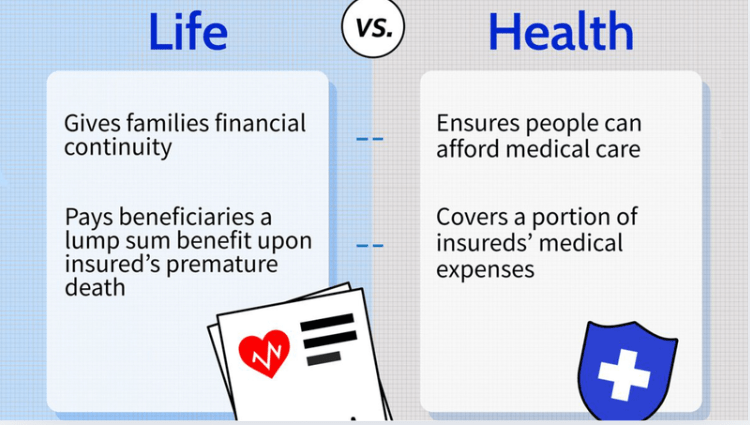

While life insurance and health insurance both provide financial security, they serve very different purposes. Life insurance focuses on providing a death benefit to beneficiaries after the policyholder’s death, supporting the family financially in their absence. In contrast, health insurance covers ongoing medical expenses, from doctor visits to surgeries, offering immediate financial assistance when healthcare is needed. Life insurance is primarily a long-term tool for legacy planning, while health insurance addresses present-day healthcare needs, offering both routine and emergency coverage for policyholders and their families.

Benefits of Life Insurance

benefits, life insurance, death benefit, financial security, family, policy, protection, savings, premiums, peace of mind

Life insurance provides a unique set of benefits focused on ensuring financial security for a policyholder’s family after their passing. The primary benefit is the death benefit, which can be used to pay off debts, cover daily expenses, or fund children’s education. By paying regular premiums, policyholders can build a safety net for their loved ones, allowing them to maintain financial stability during a challenging time. Life insurance also offers peace of mind for the policyholder, knowing that their family will be supported financially. For some, certain policies also build savings or cash value over time, offering additional long-term benefits.

Benefits of Health Insurance

benefits, health insurance, coverage, medical expenses, protection, policy, healthcare, provider, treatment, financial security

The primary benefit of health insurance is the ability to cover medical expenses without significant out-of-pocket costs. Coverage often includes routine check-ups, surgeries, hospital stays, and prescription medications, which provide essential protection for policyholders. By having health insurance, individuals and families can access quality healthcare services and focus on treatment rather than financial stress. Health insurance policies typically offer networks of providers to ensure policyholders can find affordable, qualified care when they need it most. This coverage is vital for maintaining physical and financial well-being, particularly in cases of serious illness or injury.

Costs and Premiums

costs, premiums, life insurance, health insurance, coverage, deductible, policyholder, financial security, savings, provider

Both life insurance and health insurance require policyholders to pay premiums, but the way costs are structured can differ significantly. Life insurance premiums are often fixed, especially for term life policies, while health insurance premiums can vary based on the policy’s level of coverage and deductibles. Health insurance may also involve additional out-of-pocket expenses like co-pays. In contrast, life insurance is often more stable in terms of cost, as policyholders pay set amounts to maintain their policy and ensure protection for their beneficiaries. Balancing these costs with the desired level of financial security is essential in choosing the right type of insurance.

Claims Process

claims process, life insurance, health insurance, policy, provider, coverage, benefits, family, policyholder, financial security

The claims process varies between life insurance and health insurance due to their different purposes. In life insurance, beneficiaries file a claim after the policyholder’s death to receive the death benefit. This often requires documentation like a death certificate, and providers typically work with beneficiaries to process the claim efficiently. For health insurance, the claims process is ongoing, as policyholders regularly submit claims for medical expenses like treatments, prescriptions, and check-ups. Health insurance providers coordinate with healthcare facilities to cover eligible expenses, simplifying the process for policyholders and ensuring they receive coverage promptly.

Long-Term Financial Security

long-term financial security, life insurance, health insurance, coverage, family, policyholder, savings, benefits, protection, peace of mind

When it comes to long-term financial security, life insurance is designed to provide ongoing support to the policyholder’s family after their death. This coverage ensures that loved ones receive a financial cushion, helping them maintain their lifestyle and cover essential expenses. Health insurance, on the other hand, offers financial security by addressing short-term medical expenses and maintaining well-being throughout the policyholder’s life. Both types of insurance contribute to long-term peace of mind by covering different types of risks and allowing individuals to prepare for both immediate and future financial needs.

When to Choose Life Insurance vs. Health Insurance

when to choose, life insurance, health insurance, coverage, protection, family, policyholder, financial security, needs, benefits

Choosing between life insurance and health insurance depends on personal circumstances and financial priorities. Life insurance is ideal for those looking to create a financial safety net for their family after they pass, offering essential protection and supporting long-term goals. Health insurance is critical for anyone seeking regular access to healthcare, covering both routine and emergency medical expenses. Many people find that having both types of coverage provides comprehensive financial security, with each policy fulfilling unique needs and offering distinct benefits.

FAQs on Comparing Life vs. Health Insurance

1. What is the main difference between life and health insurance?

Life insurance provides a death benefit to beneficiaries after the policyholder’s death, while health insurance covers medical expenses and healthcare needs throughout the policyholder’s life.

2. Can I have both life and health insurance?

Yes, having both life insurance and health insurance is common and provides comprehensive financial security for both long-term protection and immediate healthcare needs.

3. How do premiums differ between life and health insurance?

Life insurance premiums are usually stable and fixed, while health insurance premiums may vary based on coverage and involve additional costs like deductibles and co-pays.

4. What are the benefits of life insurance?

The primary benefit of life insurance is the death benefit, offering financial support to a family after the policyholder’s passing, helping with expenses and future planning.

5. How does health insurance support my healthcare needs?

Health insurance provides coverage for medical treatments, hospital stays, and preventive care, reducing the financial burden of healthcare expenses and ensuring access to necessary services.