insurance, choosing, policy, coverage, premiums, deductible, benefits, financial protection, risk, needs, types, comparison, quotes, options, provider, family, peace of mind, budget, liability, security, healthcare, affordability

Understanding Your Insurance Needs

insurance, needs, coverage, financial protection, family, peace of mind, budget, risks, security

When choosing insurance, the first step is understanding your needs. Insurance provides financial protection in emergencies, whether for healthcare, life, or property. Consider what is most valuable to you—whether it’s ensuring your family’s security, covering medical costs, or protecting assets. Knowing your needs allows you to select the right coverage and ensure peace of mind without overspending on premiums.

Types of Insurance Policies

types, insurance, policies, coverage, benefits, healthcare, liability, property, family, security, financial protection

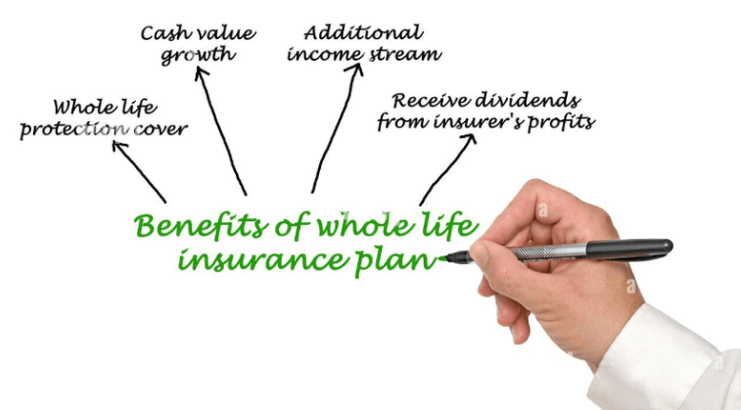

There are several types of insurance policies designed for different needs. Healthcare insurance covers medical costs, while life insurance provides financial support to beneficiaries after the policyholder’s death. Property insurance secures assets like homes or vehicles, protecting them from unexpected damages. Each type offers unique benefits and coverage options that help meet family and personal security goals. Understanding each type can help you find the best financial protection for your needs.

Assessing Your Budget for Insurance

budget, insurance, premiums, deductible, coverage, affordability, needs, financial protection, comparison, quotes

Establishing a budget is crucial when choosing insurance. Monthly premiums and deductibles vary across providers, so assess your finances to determine what you can afford. Low premiums may mean higher deductibles, and vice versa, so it’s essential to find a balance that meets your coverage needs without compromising affordability. By requesting quotes from different insurers, you can compare costs and ensure your budget aligns with the financial protection required.

Comparing Insurance Policies and Providers

comparing, policies, providers, insurance, quotes, options, premiums, coverage, benefits, security, peace of mind

To choose the right insurance policy, compare multiple providers and policies. Reviewing quotes from various insurers helps you find competitive rates, while exploring different coverage options ensures your specific needs are met. Look for policies that offer essential benefits like comprehensive coverage or liability protection. The right provider will give you confidence and peace of mind, knowing that they’ll be there when you need them most.

Understanding Premiums and Deductibles

premiums, deductibles, insurance, coverage, budget, affordability, benefits, financial protection, provider, policy, cost

Premiums are the payments you make to keep your insurance policy active, while a deductible is the amount paid out-of-pocket before coverage kicks in. Policies with low premiums often have high deductibles, which can be a good choice for those looking for low monthly costs but prepared for upfront expenses. Conversely, higher premiums generally mean lower deductibles, which can benefit those seeking broader financial protection with minimal out-of-pocket costs. Selecting a plan that balances affordability with necessary coverage is essential.

Evaluating the Provider’s Reputation and Support

evaluating, provider, insurance, reputation, support, claims, peace of mind, security, financial protection, trust, benefits

Choosing an insurance provider with a solid reputation is vital for long-term peace of mind. Research the provider’s claim-handling process, customer reviews, and history of financial stability. A reliable provider will offer strong customer support and ensure timely claim payments, making sure you and your family receive the necessary financial protection when it matters most. Trustworthy providers are crucial to maintaining confidence in your insurance investment.

Customizing Insurance Coverage to Fit Your Life

customizing, coverage, insurance, needs, benefits, family, budget, protection, flexibility, options, policy

Customizing your insurance coverage is important for addressing unique needs and lifestyle factors. Many insurers offer add-ons or optional benefits that provide flexibility, allowing you to tailor the policy. For instance, a young family might want additional protection for dependents, while someone with fewer obligations may prefer a simpler policy to reduce budget impact. By selecting options that align with your priorities, you gain a personalized policy that offers both security and financial protection.

FAQs on Choosing the Right Insurance

1. What should I consider first when choosing insurance?

Start by assessing your needs and what type of financial protection is most important to you, such as health, property, or life coverage.

2. How do premiums and deductibles impact the cost of insurance?

Premiums are regular payments, while deductibles are out-of-pocket costs before coverage begins. Low premiums usually mean higher deductibles, so balance these based on your budget.

3. Is it essential to compare insurance providers?

Yes, comparing providers helps you find competitive rates, comprehensive coverage, and customer support you can rely on in the long term.

4. Can I customize my insurance policy?

Many insurers allow customization through optional benefits or add-ons, letting you tailor coverage to fit personal or family needs.

5. How do I know if an insurance provider is reliable?

Research the provider’s reputation through reviews and check their claim process efficiency and financial stability to ensure trustworthiness.